Accounting automation software has moved from “nice-to-have” to “mission-critical.” Growing businesses can no longer afford to spend hours on manual data entry, reconciliations, or extending month-end close. Fortunately, they don’t have to. Today’s accounting automation software helps teams maintain accurate, compliant financial data while accomplishing more without expanding headcount.

Many products offer automation, but not all deliver the adaptability and end-to-end visibility that growing organizations require. Accounting Seed stands out because it’s highly configurable and scales alongside your business.

Before we highlight the top picks, let’s define what accounting automation means.

What is accounting automation software?

Accounting automation software streamlines repetitive, rules-based tasks—like journal entries, reconciliations, approvals, and reporting—so you can boost your team’s efficiency. With less time spent on manual processes, your team can focus on strategic analysis and decision-making instead of wrestling with spreadsheets.

AI’s impact on accounting automation

More and more, AI is changing how automation works. Modern accounting software can handle all kinds of tasks, including categorizing expenses, processing and extracting invoice data, detecting anomalies, and reconciling general ledgers with great accuracy.

The technology’s accuracy, however, depends entirely on the data it’s fed. Accounting Seed, for instance, is built natively on Salesforce, unifying CRM and financial data on one platform. This gives AI a clean, reliable foundation to automate with confidence and surface real-time insights. Having a single source of truth also makes it simple for accountants to verify the numbers when needed.

Considerations when building on top of existing systems

As mentioned earlier, data quality is the backbone to any effective automation software. Disconnected apps and manual CSV transfers create serious risks: version control issues, compliance gaps, and endless debates about which system is right. Many accounting tools sync just once every 24 hours, meaning those “real-time” dashboards are already outdated by the time you see them.

Consider a platform like Accounting Seed that eliminates data silos and enables sales and finance departments to work cohesively all in one platform. No syncing delays, no integration errors—just up-to-date, accessible, and clean data exactly when you need it.

Benefits of accounting automation

Here’s what finance teams typically gain with the right accounting automation software:

- Time savings: Reduce manual entry to accelerate monthly and quarterly closes.

- Improved accuracy: Minimize human error through automated validations and standardized templates.

- Better compliance: Stay audit-ready with a complete, searchable audit trail and consistent controls.

- Scalability: Support rapid growth and increased transaction volume without expanding your team.

- Enhanced visibility: Access real-time dashboards and insights that drive smarter decision-making.

To achieve these outcomes, focus on features that support your current processes today and scale with you in the future.

Key features to look for in accounting automation software

When evaluating which automation software works best for your finance team, focus on features that will meaningfully improve your processes. Some key features to consider are:

- AI-powered automation including conversational agents for natural language queries, collections prioritization, automated payment matching, and intelligent financial reporting

- Secure document management & audit trails with centralized file storage, audit logs, and granular access permissions

- Multi-entity & accrual support to handle complex organizational structures and consolidations seamlessly

- No-code workflow configuration, such as approvals, posting rules, and custom templates—no developer required

When your accounting system lives alongside your customer data, everything moves faster. Platforms like Accounting Seed eliminate integration overhead while making critical data instantly accessible.

Comparing popular accounting automation solutions

Different teams need different things. With so many accounting automation tools on the market, the right choice depends not just on your size and goals, but on how seamlessly finance ties into the rest of your business.

Think of it this way: most accounting software sits on an island, forcing you to shuttle data back and forth with ferries of exports, imports, and syncs. It’s slow, error-prone, and frustrating.

With a Salesforce-native platform like Accounting Seed, finance isn’t off on an island at all. It’s already on the mainland. Your accounting data lives right alongside sales, service, and operations, so everyone works from the same source of truth without extra transfers or syncs.

Here’s how today’s most popular platforms compare:

Accounting Seed

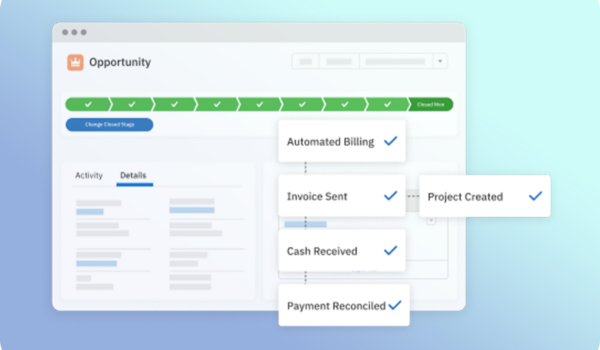

Accounting Seed brings finance closer to the business with a single platform that connects from lead to ledger. Teams can configure automations without needing a developer and can utilize AI agents that assist with payables, invoices, and collections. This solution offers various controls to support growth, while real-time dashboards give leaders confidence in every number.

QuickBooks

QuickBooks is a popular starting point for small- to mid-size businesses that want to get out of spreadsheets. It offers fast setup, a user-friendly design, and a broad app marketplace for add-ons. However, as complexity grows in multi-entity needs, advanced approvals, and tighter audit controls, teams often require integrations or workarounds to scale.

See why finances teams are leaving QuickBooks behind and switching to Accounting Seed.

NetSuite

NetSuite is a well-established option for mid-market to large organizations that want an all-in-one suite. It provides strong core financials and a wide module set, but implementations can be heavier and customizations need dev assistance. For companies already on Salesforce, maintaining integrations between NetSuite and CRM data adds extra cost and complexity.

Explore the top five signs that it’s time to transition from NetSuite to Accounting Seed.

Xero

Xero offers a clean interface with modern bank feeds and a robust app ecosystem that suits small teams and firms. It does well with straightforward accounting and light automation. For more complex workflows or close alignment with Salesforce data, teams may want to opt for a platform with greater controls.

Dru Dalton, the founder and CEO of Real Thread, said that doing “accounting through Salesforce with Xero or QuickBooks would take 2-4 times longer. Accounting Seed is the perfect customizable accounting solution to a custom-built Salesforce solution.”

FreshBooks

FreshBooks focuses on invoicing, time tracking, and simple expense management for freelancers, agencies, and very lean teams. Easy to adopt, this software keeps billing clean, but has limited GAAP depth and auditability. As requirements expand, finance leaders may need to move onto tools with stronger automation.

Sage Intacct

Sage Intacct serves the mid-market with strong financials, reporting, and consolidation capabilities. Many companies integrate it with Salesforce, but that often means duplicate work and sync delays. For teams that need real-time data across sales and finance, those extra steps can add unnecessary complexity.

Read Accounting Seed success stories

In general, automation elevates how finance teams and businesses work every day. Across industries, those using Accounting Seed report measurable gains.

- LB Technology: After implementing Accounting Seed, this fleet-services company automated complex, subscription-based billing and shortened time-to-cash, resulting in 100%+ revenue growth in two years without adding back-office staff.

- Gordon James Realty: Expanded beyond property management into maintenance services with custom workflows built in Salesforce and Accounting Seed. The team streamlined work orders, billing, and reporting in one system, keeping growth efficient and manageable.

- Brindlee Mountain Fire Apparatus: Replaced a patchwork of systems with a single source of truth using Accounting Seed. They cut the monthly close from 25 days to just three, giving leadership faster insights and stronger decision-making.

See more success stories from organizations that use Accounting Seed.

How to choose the right accounting automation software for your business

The most common (and most expensive) mistake isn’t picking the “wrong” feature—it’s choosing a system you’ll outgrow in a year or two. Re-platforming at that point means retraining your staff, rebuilding integrations, and revalidating controls. Our tip: Select an accounting automation solution that you know will scale from day one.

We’ve put together a checklist of questions to ask yourself and your team when looking at software options:

- Scalability: Will it handle higher volumes and more complexity without forcing a re-platform?

- Flexibility: Can you configure workflows without heavy developer support?

- Data model: Does it reduce silos and deliver real-time visibility across teams?

- AI-readiness: Does the software give you clean, real-time data so AI can deliver reliable insights and automation?

Accounting Seed answers these questions with a Salesforce-native platform designed to grow with your business. Flexible automation and AI Accounting Agents accelerate processes across GL, collections, and payables, so you won’t be forced to switch tools as your business expands.

See Accounting Seed in action

See how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.