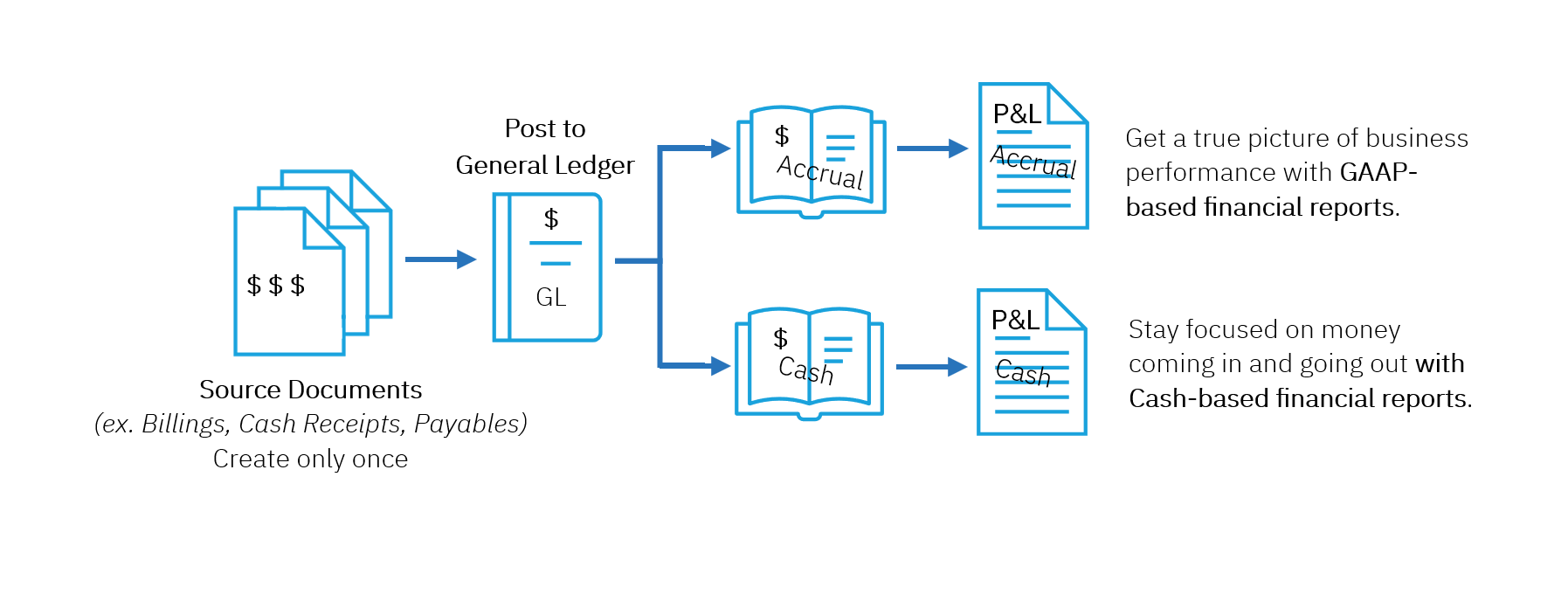

Greater efficiency without sacrificing accuracy

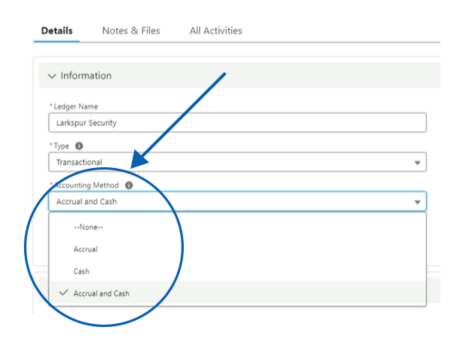

Running both GAAP- and cash-based financial statements is effortless with Multi-book Accounting. The simplicity of entering financial transactions once and having them created for both accrual- and cash-basis gives you the ability to quickly see a true picture of business performance while still closely monitoring money coming in and going out.