product overview

Cloud-based accounting software

Gain real-time visibility into financial performance with flexible general ledger capabilities and automated accounting workflows.

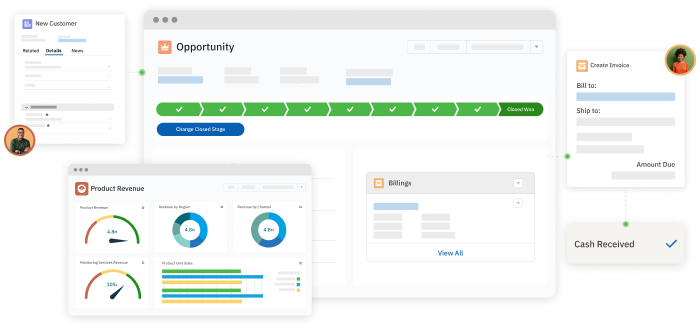

from opportunity to invoice

Everything you need to seamlessly connect financial data company-wide

Accounting core

Gain a complete view of your business performance with reliable financial data—all with cloud-based accounting software within the Salesforce platform.

- Streamline accounting processes

- Reduce risk of data errors

- Configurable general ledger, AP, AR, and more

Financial Analytics

Drill into business performance and gain deeper insights into the health of your organization with key metrics displayed in powerful dashboards and charts.

- Visualize financial and performance goals

- Analyze revenue and spend

- Slice and dice data across multiple segments

Project accounting

Simplify project accounting processes with accounting solutions that cover time and expense.

- Track revenue, expenses, and time against projects

- Compare to budget and analyze project profitability

- Automatically bill clients when the work is complete

Orders & inventory

Create purchase orders and sales orders with ease and manage inventory across multiple locations.

- Track products in multiple regions

- Build products from raw materials

- Bundle products into kits

Multi-entity & multi-currency

Leverage multi-level consolidations and easily report on results across multiple dimensions

- Combine results from two or more entities

- View results across multiple dimensions

- Perform accounting transactions in a different currency

Salesforce connectors

Accounting Seed is an online accounting software built natively on Salesforce, which means seamless integration of data from opportunity to invoice.

- Connect to any Salesforce application such as Sales Cloud, Revenue Cloud, and Service Cloud

- Access pre-built integrations between Sales Cloud and Accounting Seed

- Use connectors specifically designed for Salesforce Non-Profit (NPSP) and Salesforce Field Service Management (FSM)

Why choose Accounting Seed for cloud accounting?

Increased efficiency

Gain efficiency and save cost by running your business from one platform.

Full customization

Scale and grow with a cloud-based accounting system that’s easily tailored to your needs.

Better visibility

Access real-time performance dashboards across sales, operations, and finance.

Enhanced productivity

Save time by cutting manual and redundant tasks with process automation

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.

Schedule my demoNot a thing was integrated, and we had no ability to pull any sort of profitability analysis. How could we set our sights on scale with all these piecemeal tools? Moving onto Accounting Seed and the Salesforce Platform gave us the capacity to grow.

JeaNae Remala Controller at LionHeart

Read LionHeart's StoryExplore resources

Videos

Explore expert content about accounting software, technology innovation, and business.

Watch videosSuccess stories

Our partners share our success with the help of our flexible, easy-to-use accounting software.

Read their stories