As your business develops, your financial management needs to be aligned to scale. This is the only way to ensure you have the financial resources in place to progress. Specifically, your accounting reflects how efficiently you can run your organization. Like any construction project, you need the appropriate tool to get the job done.

If you’re building a house, a nail gun will serve you more efficiently than just a hammer – it’s the same principle with your accounting system, particularly for the general ledger! Let’s take a look deeper at how and why you should scale your accounting.

Why Does Accounting Need to Scale?

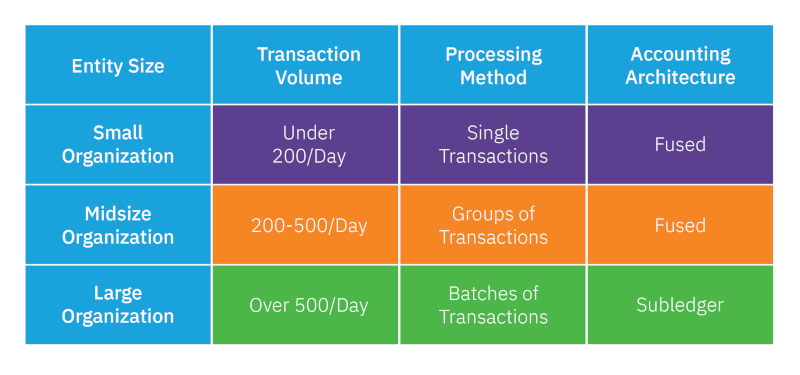

Accounting is very different between small-to-medium and enterprise businesses. The bottom line is that complexity in accounting is typically driven by transaction volume. The rate of things like sales invoices and cash receipts reflects the generation of debits and credits that the company’s accounting system must account for.

A common misconception is that accounting should be based on revenue size. This is not the case. A billion-dollar company may only have a few transactions per year, while a 5-10 million dollar company could have extremely high volumes of transactions if it’s selling low dollar items.

The number of transactions reflects the scope of detail needed in your general ledger and other central accounting features. Therefore, to scale effectively, you must think about what the transaction volume looks like in your organization and whether it’s increasing going forward. Scaling your accounting involves examining how your general ledger is equipped to manage these transactions.

General Ledger: Foundation of the Accounting System

The core of any accounting system is the general ledger. All your transactions generated from your various financial interactions or via banks ultimately flows into the general ledger. Here’s what makes the general ledger the core of accounting and a central consideration for how you scale.

- The general ledger is a comprehensive record of all accounting activities for a legal entity.

- Detailed transactions, or transactions recorded in summaries, are housed in the general ledger.

- The general ledger is used to prepare core financial statements such as the balance sheet, profit and loss, cash flow, and statement of equity.

- The general ledger provides the basis for bank reconciliation.

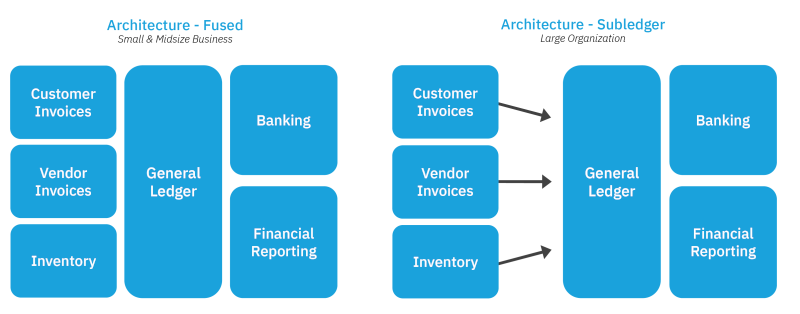

The accounting system’s general ledger structure and capacity are defined by two primary architecture formats: fused and subledger.

Fused v. Subledger Accounting System Architecture

The restrictions, or lack thereof of these two architectures, are what ultimately dictates how scalable and flexible your financial management can be. Remember, this reflects how your general ledger is structured to manage and document transactions.

The central difference between fused and subledger architecture involves how entries in the general ledger correlate to processing transactions. In a fused system, there is a one-to-one correlation between source transactions and accounting entries. Every time a source transaction is done, the general ledger is updated with the individual transaction(s).

In contrast, a subledger system utilizes a many-to-one correlation between source transactions and accounting entries. The subledger serves as a self-contained accounting unit containing transaction details needed for a summarized journal entry recording the net accounting change in a general ledger. This can be recorded for a specified time period such as a day, week, or month. Companies with a high rate of transactions can manage bulk transactions more easily and faster through the subledger system.

When Does a Subledger Make Sense to Use?

If you’re generating under 200 transactions a day, a fused ledger system is typically more useful; the one-to-one process is manageable and simple. As companies shift into the midmarket with about 200-500 transactions a day, being able to manage these transactions in bulk becomes easier and less demanding. However, the fused system can work and is still often utilized. More transactions than this though, and they become too numerous and complex to handle on the one-to-one ratio.

If your company is generating a high volume of transactions – over 500 per day – the subledger accounting system is more practical for you to use. This will reduce the amount of time and labor you need to record and understand all these journal entries because they can be done in bulk. This efficiency can also help you improve accounting accuracy because you can sort through the data based on periods or specific batches to isolate specific information. This saves time from having to sort through each individual entry for answers. Because of this, many businesses elect to use a subledger system if they anticipate high growth.

Another reason to choose the subledger system is when the nature of the transactions or returns are highly specialized. Transaction types can be allocated and accounted for more easily in the subledger. There are several examples of the subledger system. Here are some examples:

- Point of sale

- e-commerce

- Non-profit donations

- Specialized billing – metered billing

- Specialized purchasing

- Specialized inventory

- Specialized projects

- Events

- Lending and loan repayment

- Payroll

- Sales and VAT tax

Subledger systems let companies manage these different entries in bulk to avoid confusion and aggregate relevant entries. For optimal accounting follow these two best practices for the subledger:

-

- Insert entries to record in the same way cash settles for entries in your bank account. This ensures a smooth and accurate bank reconciliation.

- Synchronize your chart of accounts between your general ledger and subledger to effectively map how transactions will flow into the general ledger. This is often overlooked, but designing a strong chart of accounts enables transactions to be recorded and recognized exactly where they belong.

Do You Need to Choose Between Fused or Subledger Architecture?

Very few platforms offer options to switch between a fused and subledger architecture. Settling on just one or the other system leaves the business somewhat limited in options. This is particularly true if the small-medium business is growing in transaction volume. If a company starts off with a fused system and its amount of transactions rapidly increases, they would need to switch to a completely different accounting solution that uses a subledger.

Accounting Seed is unique in that it allows you to access both types of general ledger architecture systems. You can run both at the same time and pick the right architecture for your company on a module basis. Accounting Seed’s flexibility accommodates all business sizes and types so you never outgrow your system, while constantly being able to readjust your accounting upon need.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.