There are many damaging and long-lasting consequences of data breach. All of them cost your company money and harm your business’s reputation. This is particularly so when financial/accounting data is lost, stolen, or altered. As accounting data theft, both internal and external, increase, so are the expanses of data breach. Let’s look at how much.

How expensive is Data Breach?

What does an accounting system security breach look like once it happens? Expensive. On average, U.S. businesses typically face a loss of $8.19M per breach. All over the world the costs of data breach range but are still very high. According to a recent article post by CSO Digital Magazine:

“Each record lost costs around $150 on average globally; in the U.S. that figure rises to $242 while in the U.K. the cost is $155 per record.”

For more data check out our 2020 Guide to Financial Security: Accounting Systems

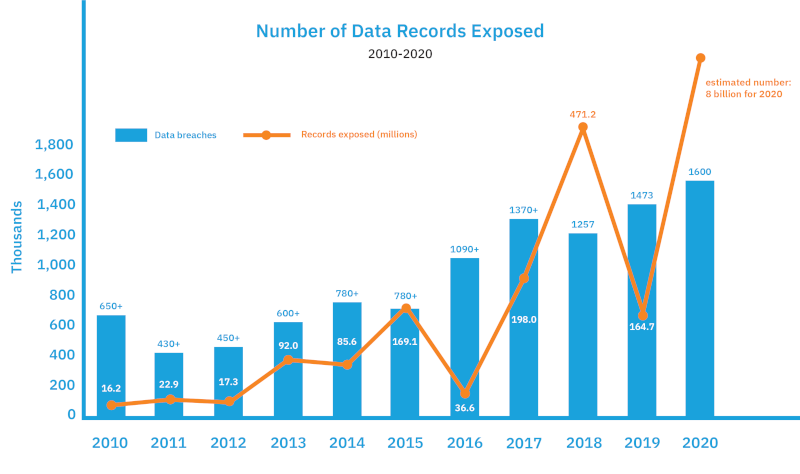

While cases of millions of data records being compromised are still uncommon, data breaches involving thousands of records are increasing. With the scope of data breaches intensifying, so are the costs of dealing with them. Historically, accounting-related data is consistently the most common data compromised. Again, these rates of data threat and associated costs are climbing.

Rising Rates of Data Breach

Currently, the average cost of data breach is about $3.86M and counting. However, some experts estimate that in 2020, the average cost of a data security breach for enterprise-level organizations could surpass $150M. This is directly attributed to increased use and connectivity of the cloud. This seems highly evident after spikes in hacking and internal fraud following the onset of COVID-19 and the increased shift of businesses to operating on the Cloud.

What Contributes to Accounting Data Breach Costs?

Unfortunately, data breaches, particularly involving accounting information, incur multiple expenses. There is no single figure for data breach cost and recovery because this is a multi-layered incident that requires collaboration and significant resources to correct. And even still recovery may not be possible. Here are some of the individual costs involved in data breach.

- Lost revenue through data loss

- Costs of reparations to customers

- Potential downsizing

- Legal representation fees

- Fines

- IT/technology costs to mitigate or fix breach

- Time/money spent dealing with the accounting data breach

- Potential backfees for payment delays

- Customer loss

- Missed business opportunities

- And more…

Besides compromising your plans for business growth and revenue streams, your whole company’s peace of mind will also be damaged. As an organization, one cannot discount the effect such a loss will have on your own staff. This also affects your partners, customers, and even credibility as an organization.

Business Failure

Companies worth millions have completely failed because of security breaches. This includes external data theft and internal data breaches, or sabotage. When accounting data is involved, the situation becomes more dire. Besides the fact that money is directly at stake, personal information and strategic business data are tied to the accounting life cycle so all this information is at risk.

This loss represents a major blow to your business objectives, cash flow, and IT integrity. Again, loss of customer trust can occur if their information and accounting data are affected, causing them to leave and for prospects to drop interest. If you’re a larger company or a nonprofit, investors and sponsors alike may also be affected. These groups might withdraw support and/or pursue legal action that could further entrench your financial burdens. The financial costs of trying to recover, coupled with the chaos of reorganizing, might be too much to handle depending on the scope of the breach.

Don’t Risk Your Wellbeing

Even if your business survives, an accounting system breach is a costly proposition that will affect you for months, maybe years, ahead. Don’t risk your business’ wellbeing with insecure accounting applications! Accounting Seed is fully equipped with internal and external security features right out of the box that you need to effectively guard your financial data amid the increasing threats online.

Is Your Financial Data Safe in 2021?

Join your host, Accounting Seed CEO Tony Zorc, for a free webinar, Protecting Your Financial Data in 2021 and Beyond, on Thursday, January 21, at 2 p.m. (ET). With over 25 years’ experience developing and selling his own accounting platform, Tony will delve into, – The threats to your accounting system – The costs of an accounting system breach – How accounting technology can help or harm your financial security – Why an accounting platform is stronger and safer than an application.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.