Guide

Don't waste another minute on manual accounting

Your guide to reclaim your time (and money) with accounting automation.

Guide

Your guide to reclaim your time (and money) with accounting automation.

It's one of the most mission-critical insights you need to run your company. Yet, most teams don't have accurate insight into cash flow on any given day — and it's a major problem.

Traditionally, businesses have leaned heavily on their accounting staff to manually track payments through accounts receivable (AR) and accounts payable (AP). This is no small responsibility, and takes a significant toll on staff time and resources.

Recent studies reveal that most finance teams spend a staggering 14 to 23 hours per week managing these two core accounting functions — between 4 and upward of 13 hours on AR, and 10 hours on AP — with 72% spending up to 520 hours per year on AP tasks alone. Plus, while AR and AP account for a large portion of manual tasks, respondents in our recent webcast stated finance teams spend 25% of their time on various manual tasks.

This manual, resource-heavy approach is becoming increasingly strained as skilled accounting labor becomes more challenging to find and expensive to manage. The number of people taking the CPA exam has seen a sharp decline from 50,000 in 2010 to 32,000 in 2021, while 75% of the existing workforce is nearing retirement. As a result, 74% of businesses report difficulties filling open accounting and finance positions and 82% of those firms are raising starting wages by an average of 9.8% in an attempt to fill vacancies.

Businesses end up paying for a larger staff of well-educated finance professionals to simply enter data and chase down records — not exactly the best use of their time.

In addition to the massive inefficiencies, wasted time, and rising cost of labor, there are three key issues businesses face with manual AR and AP processes.

As businesses grow and transaction volumes increase, manual AP/AR processes become constrained. This hurts your cash flow management. Without the right tools to support growth, overburdened staff struggle to keep up, increasing the risk of error and missed or delayed payments. So you hire more staff, driving up costs for salaries and benefits.

In many cases finance has been viewed as a backward-looking function rather than a strategic driver. Your team can’t add value beyond managing your books if they’re too busy getting bills into the system, sorting invoices, matching records, and mailing checks. With the increasing competitive landscape businesses are facing, it's imperative to partner with finance for strategic direction and visibility into profitability.

When your accounting is siloed, it's difficult to understand what's driving revenue. Without this visibility, the finance team cannot serve as a partner in identifying opportunities to help the business grow. Is a certain product line more profitable than another? Are discounts impeding growth? As you waste time stitching together data located in different places, those key insights remain buried, and you're not able to access them in a timely manner.

As businesses grow and transaction volumes increase, manual AP/AR processes become constrained. This hurts your cash flow management. Without the right tools to support growth, overburdened staff struggle to keep up, increasing the risk of error and missed or delayed payments. So you hire more staff, driving up costs for salaries and benefits.

In many cases finance has been viewed as a backward-looking function rather than a strategic driver. Your team can’t add value beyond managing your books if they’re too busy getting bills into the system, sorting invoices, matching records, and mailing checks. With the increasing competitive landscape businesses are facing, it's imperative to partner with finance for strategic direction and visibility into profitability.

When your accounting is siloed, it's difficult to understand what's driving revenue. Without this visibility, the finance team cannot serve as a partner in identifying opportunities to help the business grow. Is a certain product line more profitable than another? Are discounts impeding growth? As you waste time stitching together data located in different places, those key insights remain buried, and you're not able to access them in a timely manner.

While the idea of accounting automation might not be new to you, today's fast-paced business demands are pushing it from a nice-to-have to a must-have. Rising labor costs and the quick tempo of business operations mean leaders have nearly no choice but to automate or fail. In fact, 90% of small to midsize businesses believe automation is key to improving financial operations and business efficiency, while 89% of executives say they plan to invest more in AR automation and payment technologies.

Embedded finance, the concept of managing payments directly within accounting software, is rapidly gaining traction in the B2B space. Traditionally, the movement of money—and the processes associated—have been completed outside the core accounting system, leading to increased manual entry, errors, disconnected data, and poor decision-making.

By embedding these functions into the accounting platform itself, businesses can automate countless steps. For instance, when a customer makes an online payment, the reconciliation process can be automated to post and match the payment to the bank account and general ledger without manual intervention.

The potential impact is immense, as B2B payments volume amounts to a staggering $27.5 trillion, with AP and AR representing 90% of that value. Despite this massive market, embedded payments currently account for only a low single-digit share of existing B2B payments volume.

However, with steady growth projected and the benefit of open APIs reducing integration efforts, Bain expects B2B embedded payments to quadruple from $0.7 trillion (2.5% share) in 2021 to $2.6 trillion (7.8% share) by 2026.

In practice, many business owners and finance leaders simply aren’t familiar with the options available to them to implement embedded finance solutions, and automate core accounting functions. One top challenge is that many companies still run their CRM and payment tracking separately from their core accounting platform. And 71% who have not implemented a more automated AR system are stalled because they lack understanding of what technology is available.

Here we’ll lay out a clear path for how you can free up valuable accounting staff time and company resources with the right solution.

77% of AR teams say they’re behind, with 22% saying they are months behind.

You’re working hard to deliver a product or service — you’re entitled to get paid for what you do and get paid on time. This is not a part of your business to put on the backburner. Right now, your AR process might look something like this:

Now you have a situation where:

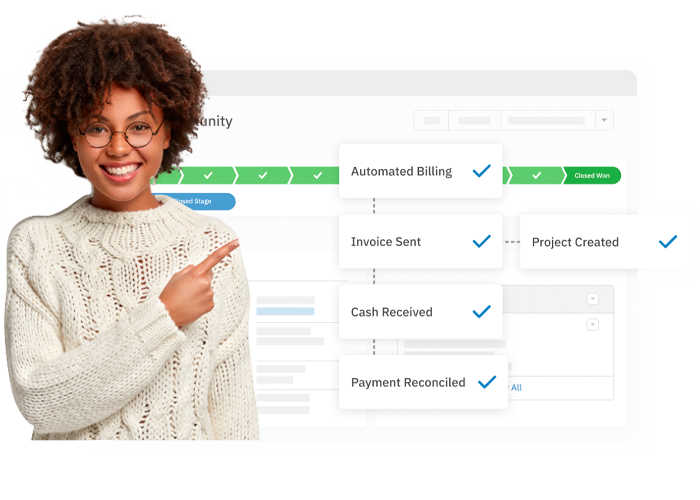

75% of full-time accounts receivable staff spend 18 hours (almost half their week) on collections alone. With Accounting Seed’s AR Automation, payments funnel into one place. The process starts when your customer receives an automated email prompting them to make a payment using your uniquely branded payment site. Online payments are safe, secure, and simple to use, helping you get paid faster. Processing fees are customizable and can be passed through to your customers, and receipts are available immediately for their records.

As payments are made on your branded site, they are automatically recorded in Accounting Seedour accounting platform and applied to the corresponding customer billings. The payment tracking offers a complete view of all payments and fees available within the payment portal. At the end of each day, the payment processor settles the day's payments in batches and moves the funds to your business account.

Research shows 56% of finance teams reconcile bank statements manually. With AR automation, the bank deposit record links directly to the journal entry, recording the movement of money into your business checking account. Bank transactions are automatically downloaded and matched to the journal entry lines created for the settled batch. Finally, when it's time to prepare your bank reconciliation, all payment transactions will clear automatically.

One study found the top benefits of automating AR reported by executives include improved productivity of the AR team (67%), increased customer satisfaction (67%) and better customer retention (56%). In addition, 89% of executives who have a mostly automated AR process are seeing customer payment terms exactly, or pay early. All in all, implementing AR automation software can reduce your time spent on cash collection by 80%.

They say “revenue is vanity, profit is sanity.” You need to be able to trust that your AP records actually reflect money going out the door to ensure you have an accurate view of profit direction. This continues to get more complicated as you add transaction volume. One study highlighted that 67% of teams manually key invoices into their ERP/accounting software, while 58% spend more than 10 hours a week processing invoices and administering supplier payments. Meanwhile, 75% of teams spend over one work week out of every month on these tasks.

Without an automated AP solution, your staff has to manually:

Your team spends so much time trying to track down and organize your bills, that you:

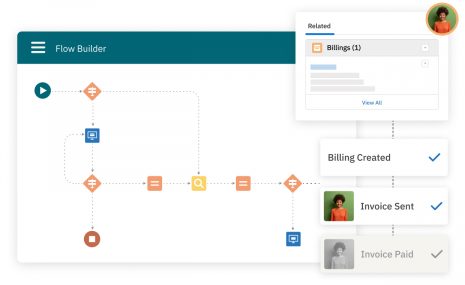

From the time you receive a bill to the time it's reconciled, solutions like Accounting Seed’s AP Automation have automated the entire process and made it possible to do everything within one platform. Not only that, because Accounting Seed is built directly on Salesforce, you can manage it all from your CRM.

First, you need to get your payables into the system more easily. With Accounting Seed, your vendors simply send your bills to a designated email address, where it will be automatically picked up and a payable created. The vendor is matched based on who is sending that bill to you. With the payable created, an image of the bill is displayed on screen so you can more easily complete any remaining fields before saving and posting.

See it in actionPayment proposals allow you to more easily search for and find bills to pay. You can perform simple searches like "I need to pay vendor X” or do more advanced searches for groups of bills, whether it's for your marketing costs, utility costs, or software licensing bills. If you have early pay discounts, Accounting Seed will take a look at your scheduled payment date and automatically calculate those discounts based on that date. You can pay the bills the same day when creating the proposal or schedule for future payment. Your team can also create proposed batches to send to your CFO or finance leader for approval.

See it in actionYou can then schedule an automated job to pay all approved proposals. Behind the scenes, Accounting Seed creates cash disbursement records and applies them to the payables. Credit memos get automatically applied, too. The cash disbursements then get automatically distributed to vendors using their preferred payment method — virtual card, ACH, or check. The vendor receives remittance advice with payment details.

See it in actionThe use of virtual cards can be a major upgrade of your accounts payable processes. Unlike regular credit cards, virtual cards provide a one-time use credit card number that is generated specifically for each vendor payment. This innovative solution delivers several key advantages.

See it in actionFirst, you need to get your payables into the system more easily. With Accounting Seed, your vendors simply send your bills to a designated email address, where it will be automatically picked up and a payable created. The vendor is matched based on who is sending that bill to you. With the payable created, an image of the bill is displayed on screen so you can more easily complete any remaining fields before saving and posting.

See it in actionPayment proposals allow you to more easily search for and find bills to pay. You can perform simple searches like "I need to pay vendor X” or do more advanced searches for groups of bills, whether it's for your marketing costs, utility costs, or software licensing bills. If you have early pay discounts, Accounting Seed will take a look at your scheduled payment date and automatically calculate those discounts based on that date. You can pay the bills the same day when creating the proposal or schedule for future payment. Your team can also create proposed batches to send to your CFO or finance leader for approval.

See it in actionYou can then schedule an automated job to pay all approved proposals. Behind the scenes, Accounting Seed creates cash disbursement records and applies them to the payables. Credit memos get automatically applied, too. The cash disbursements then get automatically distributed to vendors using their preferred payment method — virtual card, ACH, or check. The vendor receives remittance advice with payment details.

See it in actionThe use of virtual cards can be a major upgrade of your accounts payable processes. Unlike regular credit cards, virtual cards provide a one-time use credit card number that is generated specifically for each vendor payment. This innovative solution delivers several key advantages.

See it in actionWhen you pay your vendors using virtual cards, you don’t pay any transaction fees. In addition, when you use virtual cards through Accounting Seed’s preferred payment processor, your organization may be eligible for rebates. Skip the fees associated with checks and ACH and deliver value to your organization with cash-back rebates on virtual cards and real-time cash flow visibility.

Managing accounts payable is draining more resources than you even realize. With manual methods, finance teams can typically process around five invoices per hour. Through the power of AP automation, this number jumps to 30 invoices per hour — a dramatic increase in productivity that can save organizations between 70% and 80% of the time typically spent on AP activities.

The evidence is clear: Manual accounting will drag your business down. In today's fast-paced business environment, you need quick and reliable visibility into cash flow. This won’t be possible if your finance team is sending invoices and paying bills by hand. It's too expensive, no one has time to do it, and it means your team is always looking backward while you miss out on crucial growth opportunities. The hours lost to these tasks quickly add up, resulting in a massive opportunity cost for your business where you can’t focus on the future. At the same time, the insights you need to grow remain hidden in financial reports you’ll never see in time to take action.

Accounting automation isn’t a nice-to-have that you have the luxury of adopting “someday.” It is a core element to your ability to succeed — here and now. Book a demo today to see how our automated AP/AR solutions can help you save thousands and reclaim your time.

"*" indicates required fields