After you’ve run a business for a while, regular tasks such as managing payroll become second nature. It’s not so easy to get a handle on annual reporting, as it only happens once a year. Yet mastering the report business is important, and not as hard as it seems.

Good year-end reporting lets you explain your company’s goals and its story to investors. A well-crafted report can significantly increase investor loyalty. If you’re unsure what’s involved or how to write a report properly, read on. We’ll explain what annual reporting is, what it needs to include, the pitfalls to avoid, and how to write a report investors will want to read.

Why Year End Reporting Matters

The standard year-end reporting format includes a letter from you to your shareholders, a description of company goals and your vision for the business, annual financial statements, and your analysis and explanation of the year’s performance.

Private companies aren’t required to file year-end reports, but many do create them as a way to gain insight into the organization, satisfy investors that their funds are in good hands, and attract new investment money.

Nonprofits in the U.S. must file annual reports with the IRS. They can also use year-end reports to show their responsible stewardship of donations (and to attract more funding).

A good report on your year-end close showcases your organization as a success story. Putting the report together takes work and planning, but it can pay off for your business in multiple ways.

1. Internal Decision Making

Your annual financial statements — AKA the cash flow statement, income statement, and balance sheet — sum up your company’s fiscal condition. Are you carrying more debt than you can handle? Is your cash on hand enough to cover expenses? What’s your net profit after expenses?

These statements give you and your team the objective information you need to make decisions. It’s easy to get excited if your sales income rockets up, but if the income statement shows expenses have grown faster, that gives you a much-needed reality check. Is the issue a temporary fluke? A long-term problem? You can’t figure it out if you haven’t crunched the numbers.

2. Paying The Taxman

Before you create your annual financial statements, you have to perform a year-end close for your bookkeeping. This involves updating your ledgers, counting inventory, settling unpaid bills, tracking spending, verifying payroll, and reconciling your bank statement. You’ll have to do most of this anyway to figure out your tax bill.

Automated accounting software can help with closing the books by making bookkeeping entries faster and more accurate than if you made those entries manually. Software also helps you adjust your bookkeeping in accordance with tax-accounting requirements, which differ from regular daily bookkeeping.

3. Informing Your Shareholders

You can use year-end reporting to show shareholders your company remains a good investment. The report shows how much the company earns and how it makes its profits, whether by new ventures, classic product lines, or trimming costs. If the year was rough for the company, the report can explain why it happened and how you’ll bounce back.

Annual reporting lets you present your company the way you’d like investors to see it. Are you an innovator rewriting industry rules? A scrappy upstart challenging the big dogs? A small, stable company that earns a steady profit? The annual report is where you tell them.

Writing The Year End Close Report

You have little flexibility when making financial statements because they’re governed by accounting regulations. Those regulations don’t affect the rest of your year-end reporting, but you should still stick to a standard format. Investors expect consistency from annual reporting, and doing something “original” may not be well received.

1. The Shareholder’s Letter

The annual report starts with a letter from you to your investors. This is where you share your view of the past year and its key business developments: the challenges you faced, the big successes, your growth, and your key innovations.

Make the letter sound personal, rather than like a press release. Keep the tone upbeat, even after a bad year — “When we reopened after the hurricane, revenue eventually stabilized,” for instance.

2. State Of The Industry

Whether your field is website design, Thai restaurants, or luxury shoes, you don’t exist in a vacuum. Year-end reporting should describe your position in your industry — rising star, established player, traditionalist, or innovator. If you’re pulling consumers from the competition, say so. If revenue was down because the entire industry slumped, make that clear.

3. Draft The Income Statement

The income statement shows how much net profit you have left from sales revenue after subtracting operating expenses, cost of inventory, payment on debts, and other costs. Investors pay close attention to this figure as a measure of your company’s strength. You can easily find an income-statement example online if you need one.

Financial statements for internal use, sometimes called “management accounts,” are informal. If your company is publicly traded, the year-end close financial statements have to be audited. Even for private companies, paying a CPA to audit the statements is the gold standard. An audit provides proof to investors you haven’t fudged the figures.

4. Describe Your Financial Position

Your year-end reporting can expand on the raw numbers in your income statement. The “financial position” section shows the details of how you make a profit. Whether you hired a high-performance sales team or spent three months finding a cheaper source for raw materials, those accomplishments show shareholders your ability to increase company earnings.

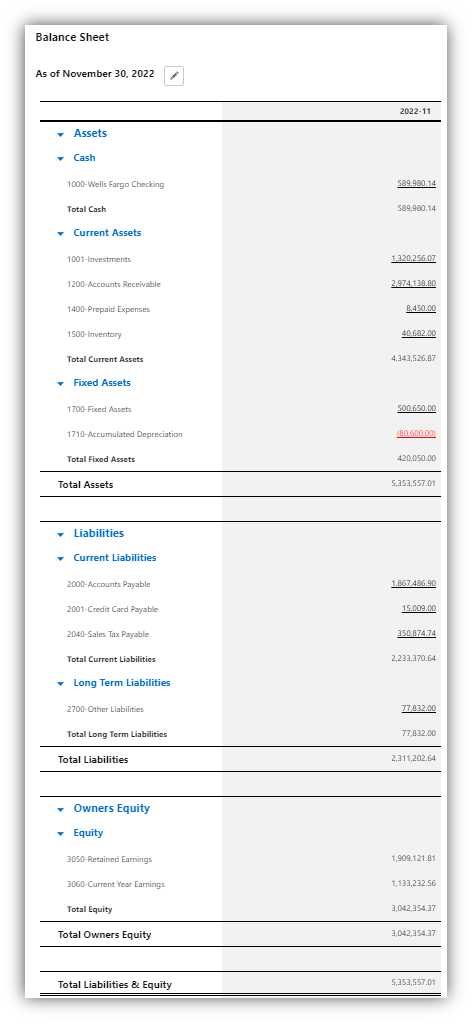

Your balance sheet, which shows your assets, liabilities, and owners’ equity, sums up your position after the year-end close.

5. Discuss Your Cash Flow

The income statement shows revenue and expenses. Meanwhile, the cash flow statement shows how much money changed hands. Knowledgeable investors want to see this because a company with no cash on hand can’t pay its bills even if revenue is healthy.

Your year-end reporting is your chance to discuss any cash-flow problems you’ve suffered. If, say, you lost track of which customers haven’t paid their bills, tell readers why that happened and how you’re correcting it.

6. Add Some Notes

Financial statements can be hard to read and understand, so make it easy for shareholders who may not be investment gurus. Provide notes for anything you think needs explaining, such as the basis for your income projections or why you increased your bad debt allowance.

Plan For The Year End Close

For the first 51 weeks of the year, it’s easy to put off thinking about the annual report. Running a company and boosting revenue gives you plenty to do, so why take on an extra bookkeeping project until it absolutely has to be done?

However, when Week 52 rolls around, you’ll wish you’d started earlier. True, if you’re using automated accounting software, closing the books and generating financial statements becomes easy to do quickly. Yet accurate year-end reporting requires more than just closing the books. Software can’t make a report engaging to read.

It takes time to choose the message your report should send, and tell the story it should tell. It takes effort to remember accomplishments from February or April if you write the report in late December. Budget time in your schedule to plan your year-end reporting, even before you’re ready to close the books.

What Message Are You Sending?

If there’s one point you want your readers to take away from the report, what is it?

- Your expanded product lines have been a smashing success.

- You made mistakes this year but you’ve learned from them.

- Projected growth for the next five years is exceptional.

- The recession hurt, but you’re poised to recover.

Your report should highlight your accomplishments, explain your successes, and share the reasons for your decisions, all in keeping with the overall message.

Company revenue needs to be part of the message. Stockholders should finish reading your report with a clear understanding of how your decisions — cutting production costs, motivating the sales team — create the revenue that generates their dividends.

Tell Readers A Story

A flat statement of facts informs readers but doesn’t engage them. Crafting your year-end reporting to tell a story is more effective. Shaping the past year into a narrative of steady, dependable growth or triumph over your competition will make your report much more readable.

This doesn’t mean you can write fiction. Like a good nonfiction book, your report has to tell a fact-based story. Investors should be able to verify your narrative by comparing it to the financial statements, and many of them will.

The best year-end reporting incorporates past years’ performance into the narrative. Show how this year’s financial successes built on last year’s. Tell a story that shows your track record of growth, of revenue, of innovation — whatever your message is — is more than a one-year fluke.

Avoid These Classic Mistakes

Whether you work on your year-end reporting in advance or during a couple of frantic all-nighters, making it good takes work. If readers study the income statement but trash the rest of your report, your work is wasted. Many reports have killed reader interest with some classic errors:

1. Too Much Information

You’ve thrown too many stats and figures at readers without building a narrative around the numbers. Don’t include weekly sales-revenue reports, for example, unless the extra data adds to the story you’re telling.

2. Inaccessible Information

Your report doesn’t have a table of contents or headings and subheadings. Long pages of text without any guidance make it hard for readers to find what they’re looking for. Year-end reporting isn’t useful if readers can’t learn what they need to know.

3. Visual Sludge

Even with a table of contents, you can turn off readers if your report is too long or contains nothing but big blocks of text. Make it easier to read by breaking it up with visual elements such as infographics, bullet lists, and quote boxes.

Make It Easy On Yourself

Accounting Seed can’t write a compelling message for you, but it makes closing the books and drafting financial statements easier. Book a demo today and see how much number-crunching an automated accounting software package can take off your hands. With an automated accounting system like Accounting Seed, the skeleton of your report will be in place and ready, so you can focus on the storytelling part.

About Accounting Seed

With over 50,000 users globally, Accounting Seed utilizes the Force.com Platform to seamlessly connect data from sales lead to accounting ledger—providing a complete view of business performance in one system without costly integrations. Want expert advice on the benefits of accounting natively on Salesforce? Let’s talk.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.