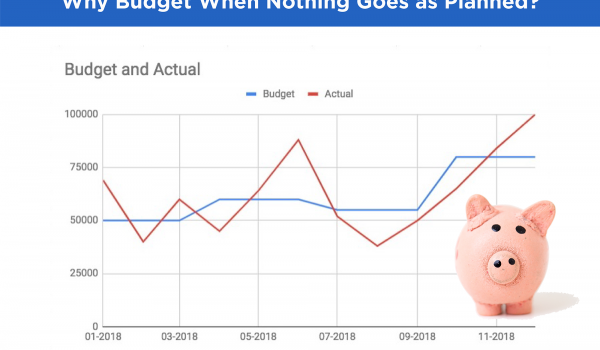

Congrats! You’ve made a master plan for your business. Your team is qualified, and your budget is prepared. But, after the first quarter, the money doesn’t align with your projected budget. When this happens, it’s known as a budget variance. Budget variance is the deviation from expected expense or revenue amounts for a defined period of time. This might make managers begin to panic, but it’s important to realize that variance is a real-world factor that’s to be expected. Keeping this in mind, it’s easy to question the need for even developing a budget when nothing seems to go as planned. But remember, you still need a measurable game plan, even if you don’t achieve every target. Understanding how variance plays a role in your finances will help you avoid costly pitfalls and spearhead improvements throughout your organization.

What is Budget vs Actual?

A budget is a financial plan that provides an estimate of expenses, cash flow, and revenue for a certain period of time. There are many types of budgets — master, operating, department, and capital. They all provide a framework of what the finances could or should look like. This helps managers pinpoint where to cap expenses to avoid profit loss and maintain fluid operations. While it’s important to stick within a budget, companies usually experience some form of budget variance. When accounting periods end, companies must compare accrued costs and revenue to the starting budget. When finances do not conform to the starting budget, this is called variance.

Actual is a term that reflects the exact amount of expenses or revenue you experienced for the defined period of time that your budget covers. If a budget serves as an estimate, the actual is the final result. For example: your operational budget might have originally been set at $400K but you ended up having to spend $450K due to operational expenses. The amount of deviation from the budget (positive or negative) is referred to as the budget variance. In the scenario above, the actual is $450K and the amount of variance is $50K.

What Causes Budget Variance?

Budget variance occurs frequently and for a wide range of reasons, for example, the need for more hours of labor or a new tool is required in order to achieve project goals. Usually, variance is caused by expenses, when decision-makers over- or under-spend on certain areas. Accounting errors can also result in a variance, which is why tracking your accounts and expenses is so important. There are also a host of external influences that can alter budgets, such as regulatory changes.

Companies will usually have a variance that reflects going over budget due to costs and unanticipated expenses, which is unfavorable. However, budget variance can be positive depending on whether the actual budget is within or exceeds budget parameters. If departments, or the company as a whole, can conserve budgets, using less money than originally planned, this reflects a positive budget deviation. The company has more money than originally anticipated which can be put to immediate use or saved for further use.

Here are examples: If sales brought in more money than forecasted, or a certain project required less time and money to complete, these are favorable budget situations. These reflect times when more revenue was gained/conserved and within the timeframe of the assigned budget. Whether you have positive or negative variance, the actual will give you indications of how you can adjust a new budget going forward.

Why Bother with a Budget?

All factors, good and bad, can reshape your budget – which is why you have a budget. If you don’t plan for expenses and revenue, you can’t effectively organize company operations. Creating a budget gives you the agility to prioritize expenses, cognition of financial strengths and weaknesses, and an overall view of financial health.

Comparing your actual costs with budget estimates can help you pinpoint areas of income leak that wouldn’t be possible without a target financial figure. The only way to improve the efficiency of your company is to have goals to measure against. Yet, this doesn’t mean a budget can’t be flexible, remember, it’s a plan. If your business is struggling to maintain one aspect of the budget, perhaps you haven’t allotted an appropriate amount for certain expenses. This is something you can uncover by monitoring your accounts and maintaining an up-to-date accounting system.A budget lets you plan ahead while remaining open-minded about your company’s money. Not using this resource will lead to you truly being lost in the real-world, instead of having a basic road-map you can adjust to cope with real-life costs.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.