As you build, or maybe update, your Salesforce org, you may be wondering what your financial management options are. Inevitably, as your business expands and sales opportunities grow, you need to account for the mounting finances of your operation. Salesforce has all the tools you need to do this, including financial management software options like Accounting Seed.

Financial Management Software For Salesforce Users

If you’re on Salesforce and you need accounting, your choice is whether to use accounting software that is built on the Platform© or to choose an outside solution. Salesforce is highly flexible and robust, so your options for either type of technology are nearly endless. But is there a better choice of the two types of software? Yes, there is. Let’s explore this by examining the two options for accounting software with Salesforce.

Native Salesforce Financial Management Software

Native software refers to applications that are built on the Salesforce platform. This means that they have the same IT architecture and Application Programming Interface (API) as the Salesforce Customer Relationship Management (CRM) platform.

Salesforce accounting software like Accounting Seed works with all Salesforce solutions and extensions like Salesforce billing without the need for traditional integration. Because of this, Salesforce users have several advantages right off the bat due to the fact that data is truly consolidated on Salesforce. Here are a few:

1. Reduced IT Costs

Expensive, custom integrations are unnecessary with Salesforce-based accounting systems like Accounting Seed. Not only do you avoid having to pay for the creation and implementation of the integration, but also periodic maintenance that must accompany integration.

2. Faster, Easier Implementation

Integrating to an outside solution isn’t just costly, it can also take a lot of time to implement. This is not the case for native Salesforce accounting software. They are pre-designed to function on Salesforce and with related tools.

3. Data Accuracy

Even with a good integration, there is still a risk of data loss due to integration malfunction. There is also potential for delay in sharing real-time data from Salesforce to your accounting system. This isn’t the case with native accounting software, it is fully connected to Salesforce.

4. Inherited Platform Features

All native solutions have shared Salesforce Platform features. These make it easier for users to track activities and monitor accounting lifecycles. Coordinate workflows and activities throughout Salesforce and your accounting system through features like Slack, Import Tools, and more.

5. Customization and Configuration

Salesforce is the most versatile platform on the market, and so are its native applications. Native Salesforce accounting solutions can be fully tailored to suit unique reporting and processes through customization and configuration.

6. High-Level Security

Native Salesforce accounting tools like Accounting Seed are fully equipped with robust IT security. Besides inheriting the highly reliable and secure Salesforce infrastructure, users can access high-level data security and internal control features right out of the box.

Outside Salesforce Financial Management Software

Salesforce can work with accounting software not built on the platform. These include familiar brands like QuickBooks, Sage Intacct, and others. These can range in functionality which, for several software options, are based on which package you purchase. But are there significant advantages for using off-Salesforce financial management systems? No, not really. The reality is that there are several disadvantages to trying to manage Salesforce solutions alongside disparate accounting software. All of which stem from the integration needed to sync the outside product with Salesforce.

Integration Carries Costs And Risks

For starters, to have a convenient, interconnected sales to accounting process, you will need to integrate the accounting product to Salesforce. Integration is expensive. Both to establish and to maintain throughout the technology’s life cycle. When Salesforce or your accounting tool updates, or new functionality is created, the integration will likely need to be modified too. This will of course cost time and money.

Data Loss And Inconsistencies

Even if you’re using a popular accounting software with a well-constructed integration, you’ll still face data risks and maintenance issues. Both of which threaten your operational efficiency, accounting accuracy, and of course, it’s also a time drain on staff. Due to the complexity of integration delays and errors can occur. Sometimes, the integration can fail entirely.

These integration issues are not the case for native software due to the fundamental construction of platform-platform technology. It is this native Let’s compare an outside accounting system with native Salesforce Accounting ERP, Accounting Seed.

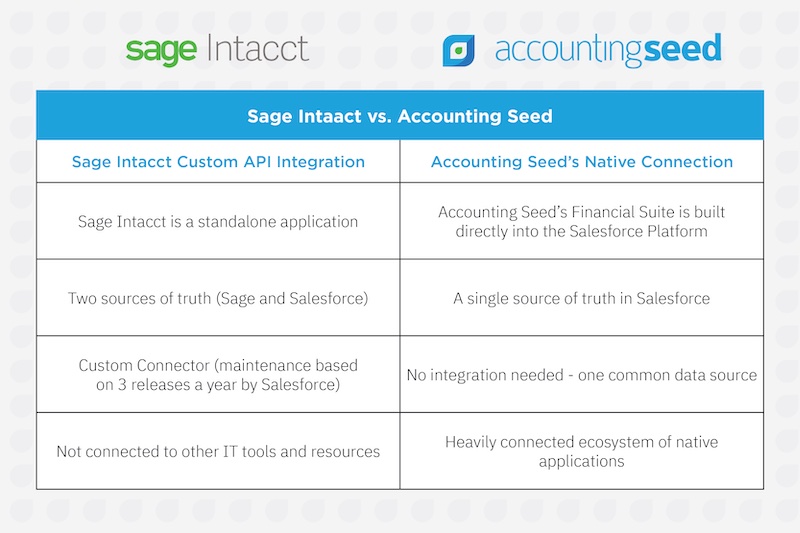

Sage Intacct versus Accounting Seed

To really see how non-native accounting apps compare to native accounting apps, let’s look at two products.

Sage Intacct is a brand-recognized accounting system that has been used by Salesforce users. But it isn’t native. Accounting Seed, on the other hand, is a top-rated native Salesforce accounting solution. Both share similar accounting tools and functions. However, there are very clear differences, especially with how they interact with the Salesforce ecosystem. Here are some differences to consider:

Sage Intacct

You’ll note that even with an integration, Sage isn’t truly connected with Salesforce, at least not fully. Data is still housed and transferred between two different systems, which can threaten data consistency, and even timeliness. Sage Intacct requires a connector to share data with Salesforce, which requires maintenance and what facilitates the constant movement of data sharing. Another consideration is consistency. The interfaces of the two systems are quite different, which can be jarring and require extensive training for staff to get used to the differences to avoid errors.

Accounting Seed

Accounting Seed greatly differs from Sage Intacct because it comes fully connected to Salesforce without the need for a connector. Because of its Salesforce design, Accounting Seed is ready to connect to every other Salesforce app too. This native design also means that our user interface is similar to other Salesforce-based products for easy work done between solutions. All in all, this gives users a truly single platform to house data, giving you ease and efficiency. Go from writing an estimate in one app and then turn it into a billing that automatically is documented in Accounting Seed. All with the click of a button because the data is present seamlessly shared on Salesforce.

Go Native, Get Better Financial Management

Working with native Salesforce accounting apps like Accounting Seed is easier, more affordable, and more streamlined. Because the layout and platform features are inherited from Salesforce itself, you can expect a smooth adoption and seamless accounting across all of your organization. But more importantly, it’s sustainable. This is because native solutions are just as configurable and customizable as the platform itself.

Getting Started Accounting On Salesforce

If you’re ready to move your financial management fully onto Salesforce, the first step is simply choosing a native accounting solution. You can begin by searching on the Salesforce AppExchange for individual solutions and filter by “Native” applications. Among the top-rated solutions is Accounting Seed. You can check out our customer stories, reviews, and awards to see why! Be sure to check out our free guide by clicking the button below.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.