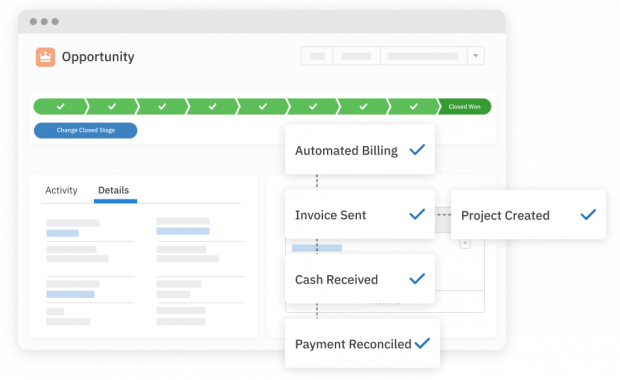

So, if you’re on Salesforce and you need accounting, the choice is whether to use outside accounting tech and deal with integrations or go native. The reality is that native accounting technology lets you avoid all the costs of integration while also giving more reliable, flexible financial management.

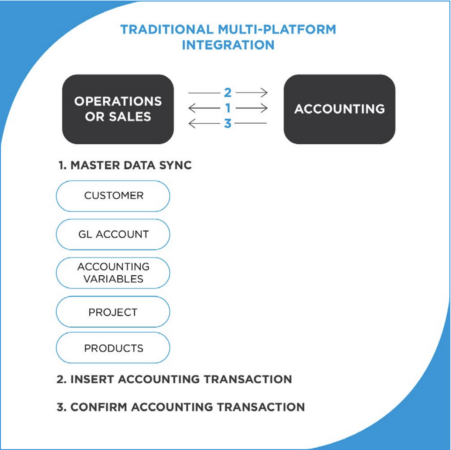

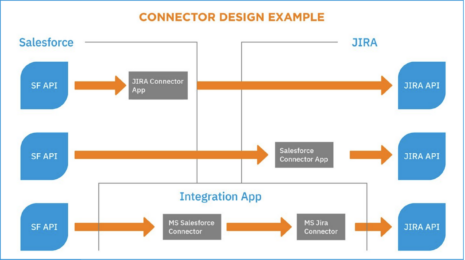

Even if you’re using a popular accounting software with a well-constructed integration, you’ll still face data risks and maintenance issues. And of course, integration maintenance will go on throughout the system’s lifecycle. This is not the case for native software.

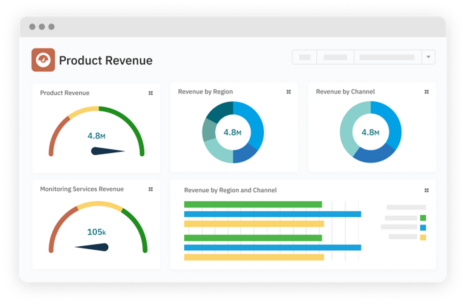

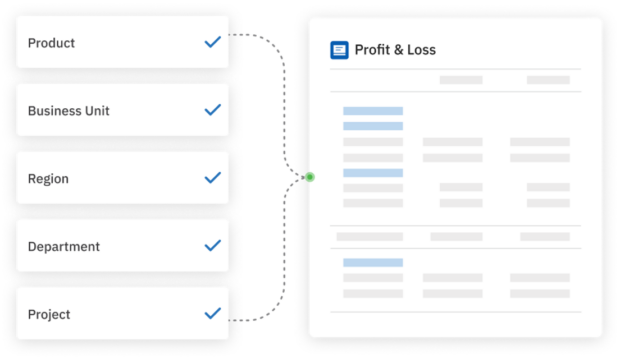

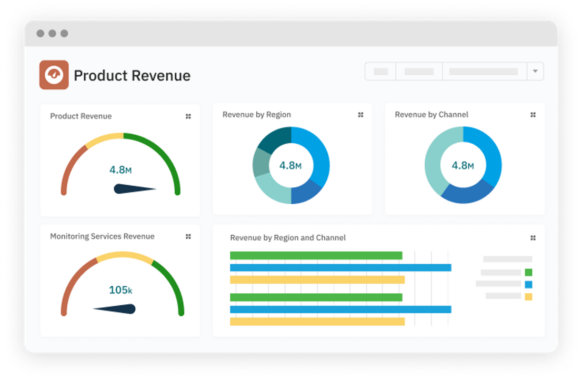

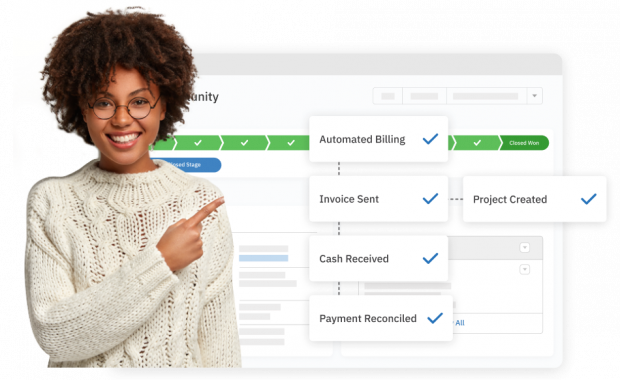

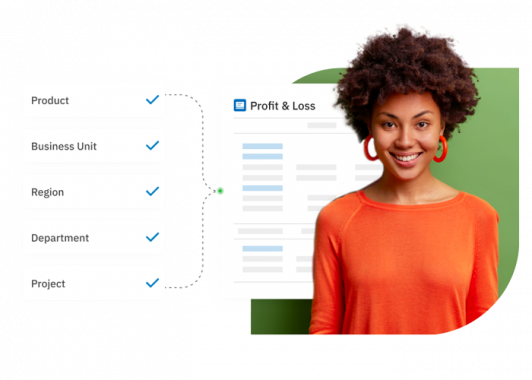

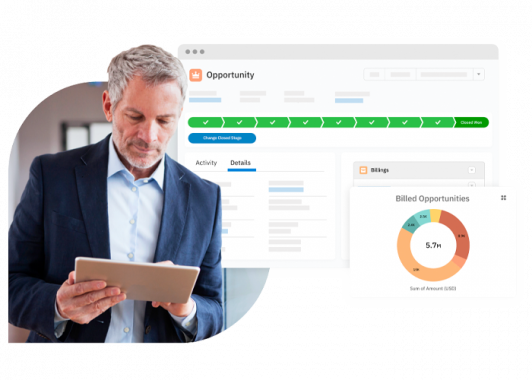

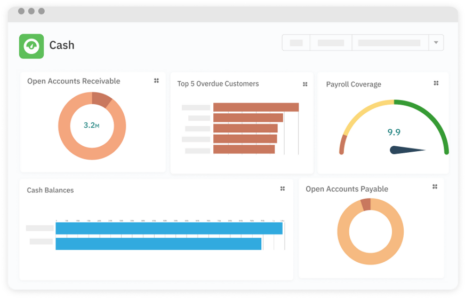

Let’s compare an outside accounting system with native Salesforce Accounting ERP, Accounting Seed. Working with Salesforce accounting apps like Accounting Seed is easier, more affordable, and more streamlined. Because the layout and platform features are inherited from Salesforce itself, you can expect a smooth adoption and seamless accounting across all of your organization. But, more importantly, it’s sustainable. This is because native solutions are just as customizable as the platform itself. And, if that’s not enough, here are some additional benefits.