Accounting careers are changing and growing in scope and potential. If you’re an aspiring accountant, be aware of the biggest trends in the accounting industry. Let’s delve into the top three accounting careers for accountants.

Has Demand for Accounting Changed?

Accountants are actually going to be in higher demand for their value in helping companies make stronger, effective business decisions. Effective financial analysis, cash flow, and money-saving strategies are critical for navigating the post-pandemic economy of COVID-19. The U.S. Bureau of Labor Business projects a steady increase in demand for accountants as the economy recovers and expands.

The Top 3 Accounting Careers for New Accountants

Accountant jobs continue to grow more analytical and advisory thanks to cloud-based accounting technology. This is seen in the three biggest careers that accountants gravitate towards. These are:

- Public Accounting (Certified Public Accountant (CPA)

- Company Management

- IT Consulting

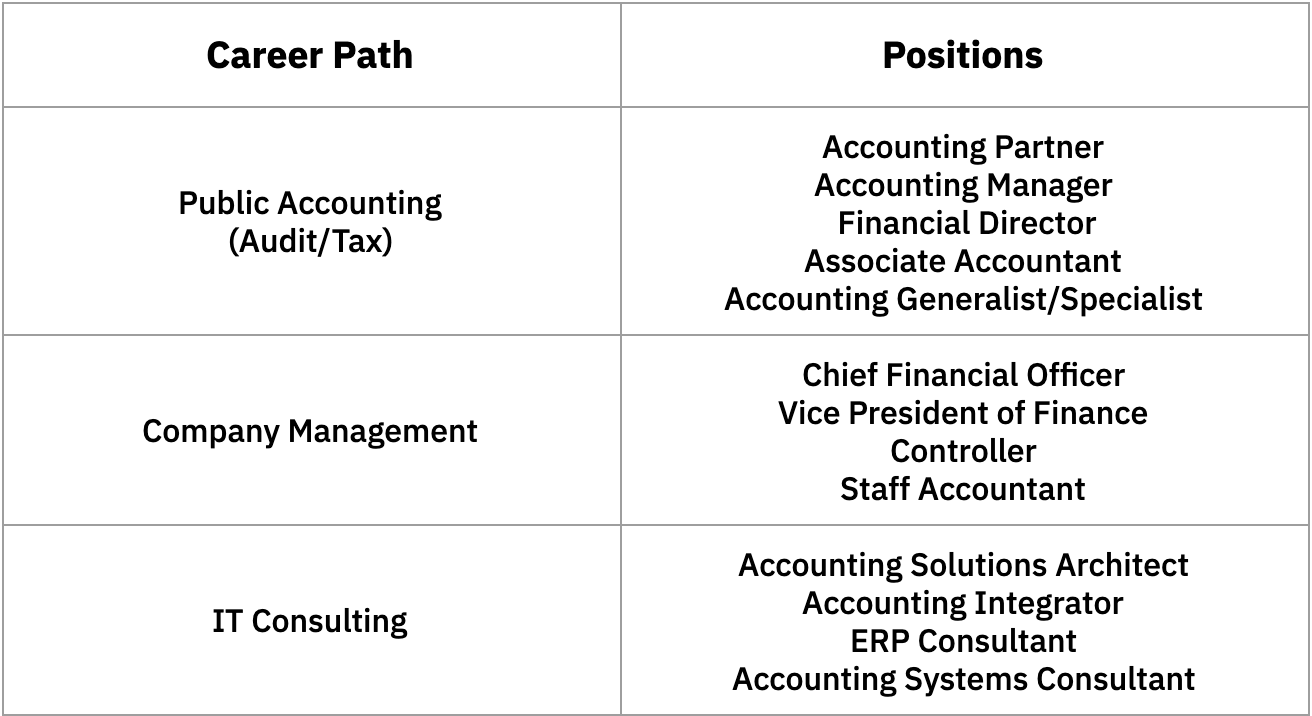

None of these careers are mutually exclusive to one another. Actually, individuals can incorporate multiple aspects of all three different career paths into their own career and work all three. Typically, these career paths have several positions linked to them based on role expectations. Here’s a breakdown of the three accounting career paths and associated jobs.

Every accountant job will require knowledge of financial management and analysis. Technology also plays a major role in these areas. The level of IT literacy needed will depend on the role you choose. Remember that you’ll want to define your career based on your interests, goals, and work preferences. Let’s dive further into each of these career paths.

Public Accounting

At the heart of public accounting is auditing and financial analysis. Think of this role as a blend of a legal and financial advisor. Certified Public Accountants (CPA) provide high-level financial insight with the goal of helping businesses achieve key goals. They analyze accounting trends and guide leaders on the best way to empower growth and stability. CPAs also consult on specific accounting issues, help companies with taxes, and facilitate auditing services.

CPAs require a lot of specialized skills and must complete the CPA exam, so this is definitely an investment of time and money. However, these skills are highly valuable and give you an edge in pursuing accounting careers. CPAs are accountants, but not all accountants meet the baseline credentials/requirements that CPAs have. This makes you stand out among candidates and opens you up for a variety of accountant jobs. These opportunities range from independent consultants to financial directors. The other main accounting career paths are totally achievable by a CPA.

Company Management

Many accountant careers are tied with some level of company management and C-level leadership. Many organizations have a dedicated financial team who are directed by managers who report to a chief financial officer (CFO). These accountants may start as a team accountant and then take on more leadership and responsibility in the company. Because money is the language of finance, accounting management has a lot of power and are entrusted with guiding decisions.

C-level accounting leaders like financial directors and CFOs focus on managing and all financial activities of the organization. Duties can also involve business planning and strategy, financial forecasting, budgets, and more. Essentially, accountants at this level have a lot of experience with financial management and business development. It’s not just about monitoring and maintaining financial health, but also spearheading ways to grow the company.

IT Consulting

Accounting technology is now an essential ingredient in modern accounting. No matter what accounting career path you choose, it will involve digital accounting and IT on some level. But, there is also a demand for accountants or IT professionals with special knowledge of accounting systems. Accountants with an interest and understanding of things like integration and accounting automation are perfect for filling this need. However, while it would help to have accounting knowledge, this type of work doesn’t necessitate accounting degrees or certifications.

Accounting IT consultants must be familiar with how digital accounting processes are triggered and managed on the cloud. It’s also vital to know how other applications will need to communicate and share data with the accounting system. Additionally, knowledge of IT platforms like Customer Relationship Management (CRM) IT environment and Enterprise Resource Planning (ERP) is important.

Want an Accounting Career? Be Tech-savvy

No matter what accounting career you pursue, being tech-savvy will give you a major advantage. All of these roles necessitate cloud-based accounting tools. Understanding how they work will help you choose the best solution to manage your accounting. That being said, why not become familiar with modern accounting tech and how to use them? Get started by checking out our free guides on Integrating to an Accounting System and Accounting Automation.

Accounting Seed is a modern, robust accounting platform powered by the Salesforce platform. We break down silos and building connections to take your business to the next level.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.